Resources & Links

We’ve compiled a collection of essential resources to help you navigate the world of taxes, accounting, and business management. Whether you're looking for forms, government agencies, or professional associations, these tools are here to support you in every step of your financial journey.

Forms

I-9 (PDF)

The I-9 form is a mandatory document used by employers to verify the identity and legal authorization of individuals to work in the United States. It is required for all new hires and must be completed within three days of starting employment.

W-9 (PDF)

The W-9 form is used by businesses to collect taxpayer identification information from contractors, freelancers, and vendors. It ensures proper reporting of income paid to non-employees for tax purposes.

W-4 (PDF)

The W-4 form is completed by employees to determine the amount of federal income tax to withhold from their paycheck. It helps ensure the correct withholding based on personal circumstances like dependents and filing status.

Direct Deposit Form (PDF)

The Direct Deposit Authorization Form allows employees to set up direct deposit for their payroll, enabling payments to be automatically transferred to a designated bank account instead of receiving paper checks.

Tennessee New Hire Reporting

Employers are required to report new employees to the Tennessee New Hire Reporting system within 20 days of hire. This helps with child support enforcement and other legal requirements.

Tennessee Separation Notice

The Tennessee Separation Notice is a form provided to employees when their employment ends. It is required by the state and details the reason for separation, which may be needed for unemployment benefits and other records.

Government Agencies

Internal Revenue Services

The IRS is the U.S. federal agency responsible for enforcing tax laws, collecting taxes, and administering the Internal Revenue Code. It ensures individuals and businesses comply with federal tax regulations.

Read More

Tennessee Department of Revenue

The Tennessee Department of Revenue manages state tax collection, including sales tax, business tax, and income tax. It also provides resources for businesses to comply with state tax laws and regulations.

Read More

Tennessee New Hire Reporting Link

This is a resource provided by the Tennessee New Hire Reporting system, where employers must report newly hired employees to help with child support enforcement and other state programs.

Read More

Tennessee Secretary of State

The Tennessee Secretary of State oversees business registrations, professional licenses, and the state's corporate records. It ensures that businesses comply with Tennessee’s legal requirements for formation and operation.

Read More

Occupational Safety & Health Administration

OSHA is a federal agency that ensures workplace safety and health by setting and enforcing standards. It provides resources for businesses to create safe working environments and comply with federal safety regulations.

Read More

Professional Associations

American Institute of CPAs (AICPA)

The AICPA is the national organization for Certified Public Accountants in the U.S., providing resources, education, and advocacy for professionals in the accounting industry. It sets ethical standards for the profession and offers certifications, training, and networking opportunities.

Read More

360 Degrees of Financial Literacy

360 Degrees of Financial Literacy is an initiative by the AICPA aimed at providing free, unbiased financial education to the public. It offers resources and guidance on topics like budgeting, retirement, taxes, and more to help individuals make informed financial decisions.

Read More

Tennessee Society of CPAs (TSCPA)

The TSCPA is a professional association for CPAs in Tennessee, offering members resources, continuing education, and networking opportunities. It advocates for the accounting profession and supports members with tools to stay up-to-date with industry trends and regulations.

Read More

Livingston - Overton County Chamber of Commerce

The Livingston - Overton County Chamber of Commerce is a local business organization that supports economic development, networking, and advocacy for businesses in the Livingston and Overton County area. It helps businesses connect, grow, and succeed within the community.

Read More

Occupational Safety & Health Administration

The Clay County Chamber of Commerce is a regional business association that supports the interests of local businesses in Clay County, Tennessee. It provides networking opportunities, business development resources, and advocacy for the area’s economic growth.

Read More

Client Worksheets

Personal Information Worksheet (PDF)

The Personal Information Worksheet is used to gather important details from you and your spouse (if applicable) to ensure accurate tax filing and financial planning. The worksheet includes sections to fill out your personal and contact information, dependent details, and other relevant data, helping us provide tailored services for your tax and accounting needs.

Download Personal Information Worksheet

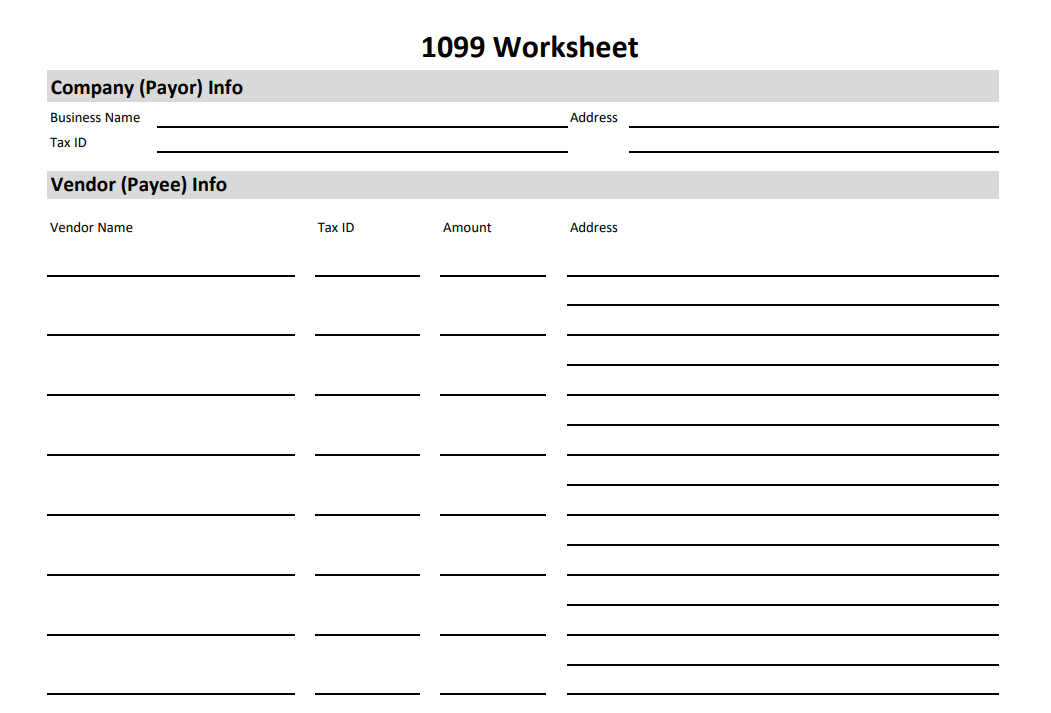

1099 Worksheet (PDF)

The 1099 Worksheet is used to collect information about vendors and contractors you paid during the year. This worksheet helps ensure accurate preparation and filing of required 1099 forms for non-employee compensation.

Download 1099 Worksheet

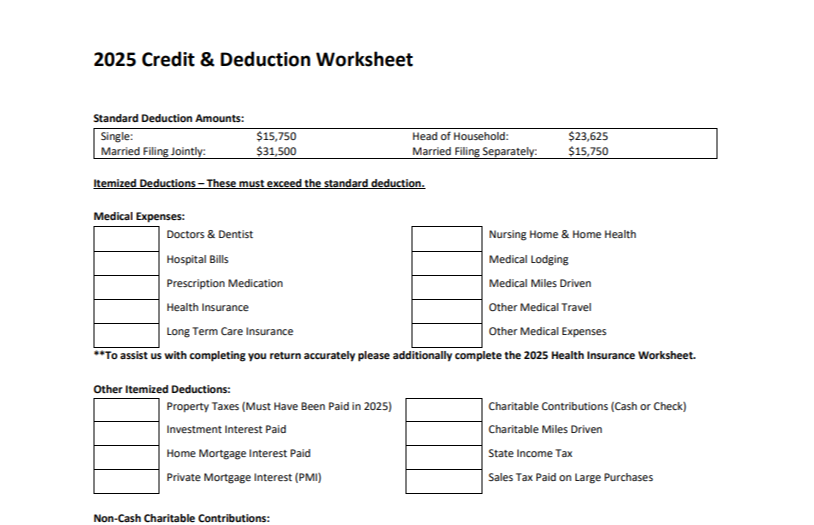

2025 Credit & Deduction Worksheet (PDF)

The 2025 Credit & Deduction Worksheet helps gather details about deductions, credits, and qualifying expenses that may reduce your tax liability. Completing this worksheet allows us to identify eligible deductions and ensure your return is prepared accurately.

Download 2025 Credit & Deduction Worksheet

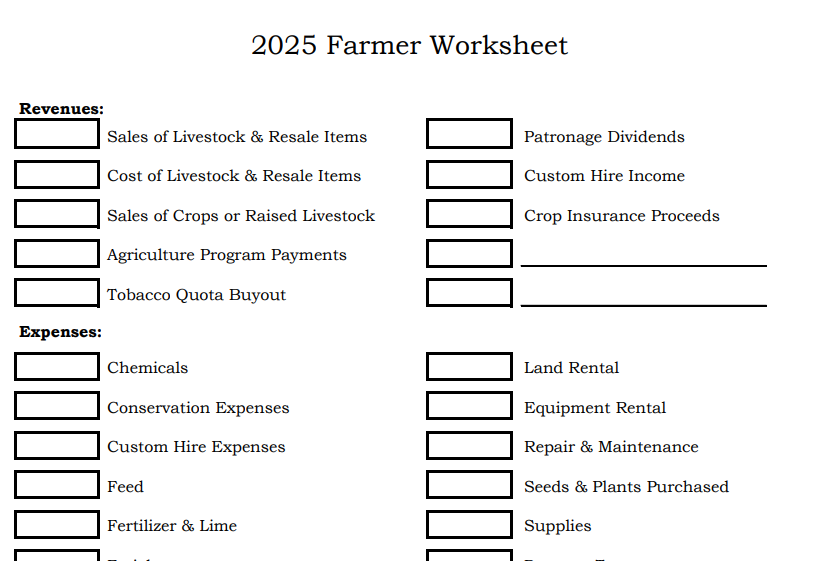

2025 Farmer Worksheet (PDF)

The 2025 Farmer Worksheet is designed for individuals involved in farming operations to report income, expenses, and asset information. This worksheet helps capture farm-related financial activity so your return reflects your operation correctly and completely.

Download 2025 Farmer Worksheet

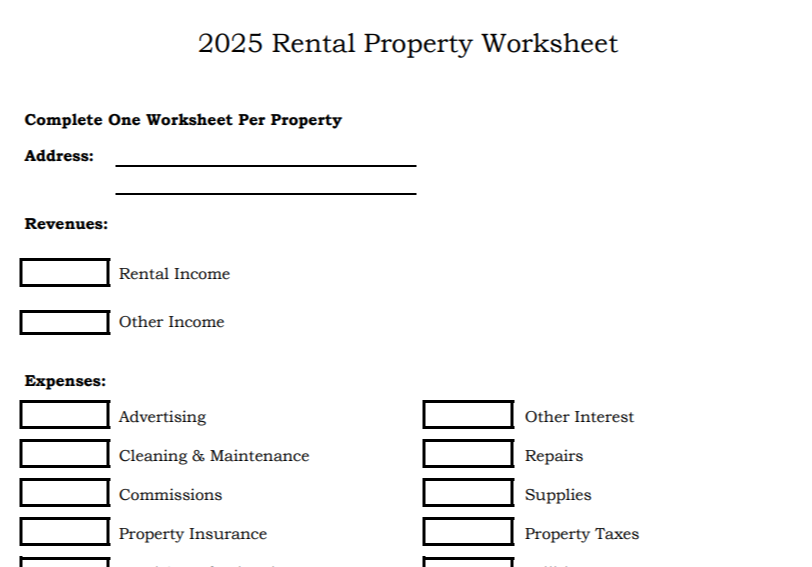

2025 Rental Property Worksheet (PDF)

The 2025 Rental Property Worksheet is used to record income, expenses, and asset information for each rental property you own. Completing one worksheet per property helps ensure proper reporting and accurate tax treatment of rental activity.

Download 2025 Rental Property Worksheet

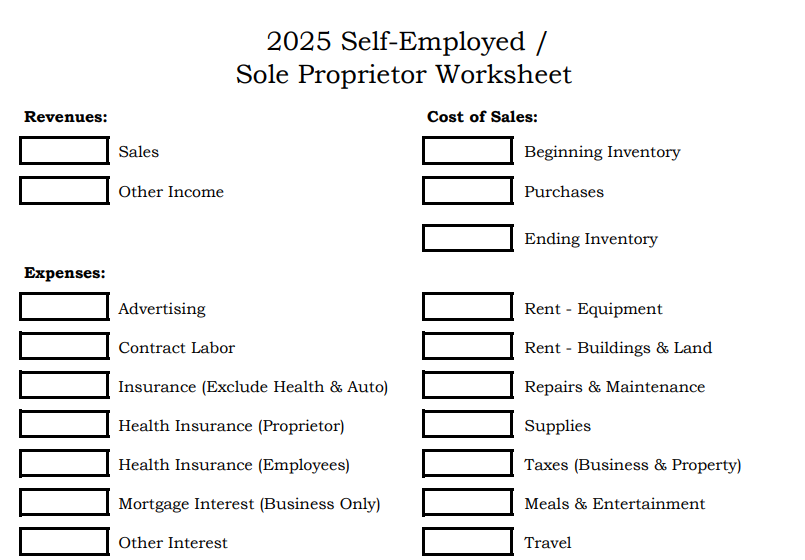

2025 Self-Employed (Sole Proprietor) Worksheet (PDF)

The 2025 Self-Employed Worksheet is designed for sole proprietors to report business income, expenses, mileage, and asset purchases. This worksheet helps us prepare your return accurately and identify applicable deductions related to self-employment.

Download 2025 Self-Employed Worksheet